A credit score is a number that ranges from 300-850 and represents your creditworthiness. A 560 credit score is on the lower end of the scale and indicates that the individual has poor credit, which means they may have defaulted on loans or have a history of missing payments.

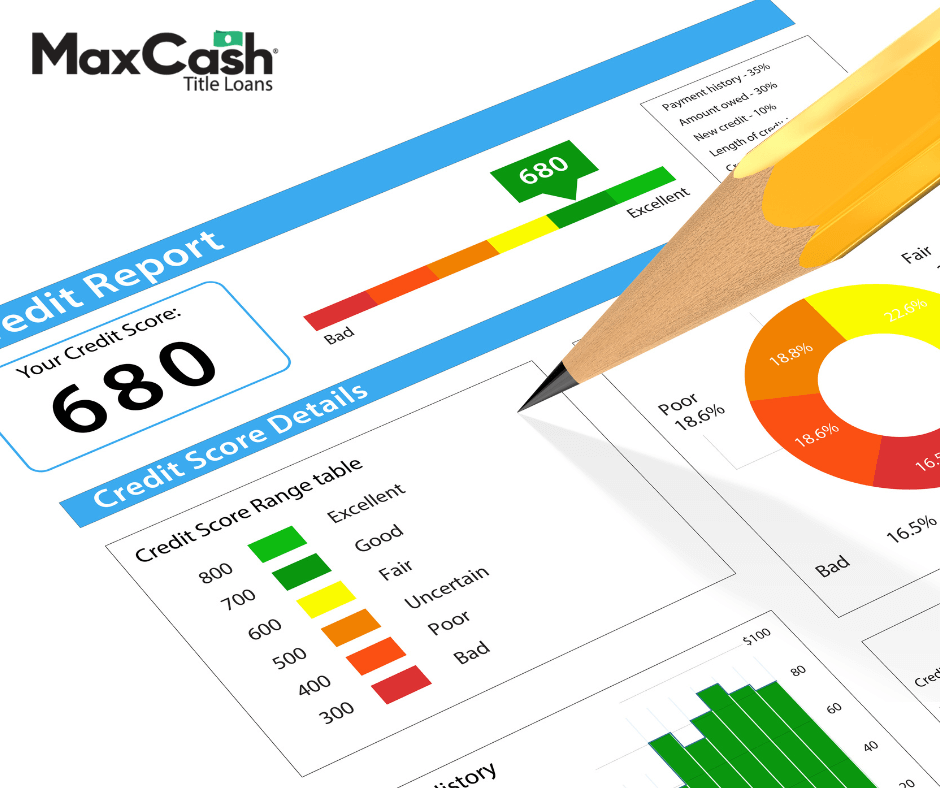

Below is the range of FICO credit scores:

800-850: Excellent

740-799: Very Good

670-739: Good

580-669: Fair

300-579: Poor

Other scoring models exist, such as the VantageScoreⓇ Model. On both scoring models, having a 560 credit score is not ideal. Generally, a score of 700 and above is considered to be an ideal spot for many consumers, but the majority of Americans fall between 600 and 750. As of 2024, VantageScore data reported that the average credit score in America is 715.

If you are dealing with poor credit, you are not alone. As you may know, however, your credit score is an integral part of your financial health. Whether you plan on applying for an apartment in the future or an auto loan for a car, it is essential to improve your credit score. Reaching your financial goals will feel impossible until your score has improved!

What Factors Impact My Credit Score?

If you have a 560 credit score and you want to improve your financial history, it’s important to understand how your score is calculated. Several factors impact your credit score, and some elements of your financial behavior will affect your score more than others. Generally, the factors can be split into five categories:

- Payment History: As a consumer the most important thing you can do is make on-time payments. Whether you have a mortgage loan or a credit card, paying off your debt obligations on time is the easiest way to improve your credit score. On the flip side, missing payments or filing bankruptcy can easily tank your score.

- Length of Your Credit Accounts: The average age of all of your credit accounts is a smaller factor that is used to calculate your credit score. That’s why you should never close an older credit card, even if you don’t use it! Closing a credit account that is older can shorten your average and negatively impact your score.

- Credit Mix: Having multiple kinds of debt can actually be seen as a positive when it comes to calculating your credit score. This shows lenders that you are capable of handling different types of debt, including revolving credit lines, installment loans, title loans, and more.

- Recent Credit Activity: If you are applying for new credit or opening a new account, that can impact your score. Generally, it’s recommended to only have 2 hard inquiries per year on your credit report.

- Overall Utilization: Your available credit is another important factor that impacts the calculation of your credit score. Most financial experts recommended keeping your credit utilization under 30%. This means that you are only using 30% of your available credit at a given time.

Your payment behavior is one of the most important factors that impacts your overall credit score. That’s why your priority should be to keep up with your debt obligations and avoid defaulting on a loan! If you have a 560 credit score, make your payments a priority and work on improving your finances.

Can I Get a Loan With a 560 Credit Score?

If you’re wondering, “How good is a 560 credit score?” The answer is that your score can hold you back in a lot more ways than you might think. In many cases, you won’t be able to get a traditional bank loan with a 560 credit score. This is due to the fact that your score falls into the bad credit range. Many traditional lenders will view you as a higher credit risk, which could mean that you are unlikely to pay back your debt.

Even though traditional bank loans may be off the table, that does not mean you are out of options. Some loans can cater to individuals without strong credit scores. Generally, using collateral for a loan can make the inquiry process much more flexible.

Therefore, your credit score may not carry as much weight as other factors! With car title loans, your car’s value and your income are the stars of the show in terms of your loan eligibility. While some title lenders may review your credit during your loan inquiry, others will not consider it.

Even if you have lower credit score than the national average, it is possible to qualify for a car title loan with the help of Max CashⓇ Title Loans!2 5 If you are eligible for a car title loan, you can access up to half of your vehicle’s value and use your funds to tackle a tough financial situation.1 5

How Do I Improve My 560 Credit Score?

As mentioned above, improving your credit score starts with paying your debt obligations on time. It will take you longer to establish a longer credit history for your accounts!

Your first step should be to create a solid budget that prioritizes paying off your debt. Track your existing expenses and income throughout the month. Once you have this data, see if there is any room for improvement. You may want to cut out unnecessary expenses like streaming services and Uber Eats so that you can focus on paying back your debt.

In some cases, having a new budget may include getting a debt consolidation loan to condense your debt into one singular payment. This can make it easier to pay off your loans and focus on one payment per month instead of multiple ones. On top of paying your loans on time, your focus should be to keep your credit utilization low.

Explore Bad Credit Loan Options With Max Cash Title Loans

While improving your credit score can open up many different loan opportunities and better interest rates / loan terms, you may not have any time to waste. Improving your credit score takes a lot of time and effort. Sometimes, financial emergencies can pop up out of nowhere! If you want to explore bad credit loan options, then Max Cash Title Loans has your back. Fill out a short inquiry form online today or call 855-561-5626 now to speak with a loan agent!5